- Introduction

- Briefly introduce the topic of comparing different types of assets returns and risks

- Highlight the importance of understanding the risks and returns associated with different types of assets before making investment decisions

- Types of assets and their risks and returns

- Provide an overview of different types of assets, such as stocks, bonds, real estate, and commodities

- Discuss the risks and returns associated with each type of asset

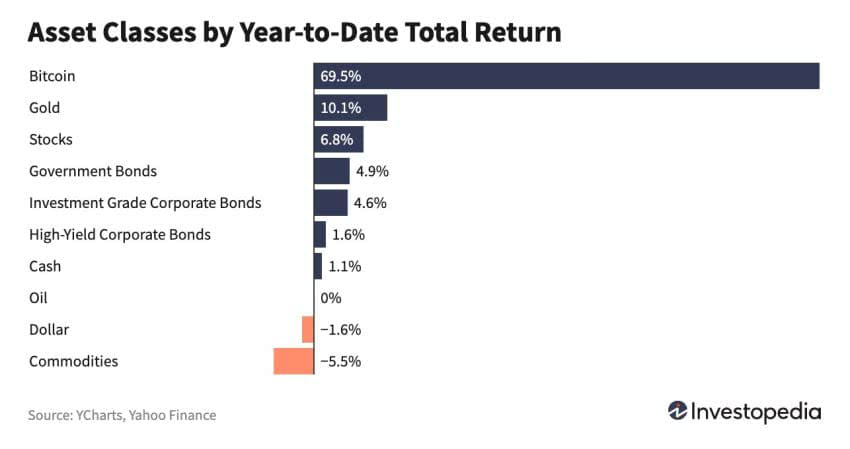

- Use data and statistics to support your analysis

- Factors that affect asset returns and risks

- Discuss the various factors that can affect the returns and risks of different assets, such as economic conditions, geopolitical events, and company performance

- Provide examples of how these factors have affected different types of assets in the past

- Evaluating asset risk and return

- Discuss the different methods that investors use to evaluate asset risk and return, such as the Sharpe ratio and beta

- Provide examples of how these metrics can be used to compare different types of assets

- Conclusion

- Summarize the main points of the article

- Emphasize the importance of carefully considering the risks and returns of different types of assets before making investment decisions

- Encourage readers to further research and seek professional advice before making investment decisions.

Introduction

Investing can be a complex and challenging task, especially when it comes to assessing the risk and return of different assets. With so many investment options available, it can be difficult to know where to invest your money and what to expect in terms of returns. Understanding the risks and returns associated with different types of assets is crucial for making informed investment decisions. In this article, we will compare the risks and returns of various types of assets, such as stocks, bonds, real estate, and commodities. By examining the different factors that affect asset returns and risks and the methods used to evaluate them, investors can gain a better understanding of the investment landscape and make more informed investment decisions.

Types of assets and their risks and returns

Crypto Assets: Crypto assets, such as Bitcoin and Ethereum, have gained popularity in recent years. These assets have high volatility and are often subject to regulatory changes and security risks. However, they have also shown the potential for high returns.

Gold: Gold is considered a safe-haven asset that investors turn to during economic downturns. It has a low correlation to other assets, making it a good diversifier in an investment portfolio. However, gold prices can be volatile and are affected by changes in the market.

Government Bonds: Government bonds are considered a low-risk investment and are issued by the government to raise funds. They offer a fixed rate of return and are backed by the government, making them less risky than other types of bonds. However, government bonds have a low yield, which can limit their potential returns.

Cash: Holding cash is considered the safest investment option. It is highly liquid and can be easily accessed. However, it offers low returns and can lose value due to inflation.

Oil: Oil is a commodity that is traded in the market. Its price is affected by global events, such as political unrest and changes in supply and demand. Investing in oil can offer high returns but comes with significant risks due to its high volatility.

Commodities: Commodities, such as agricultural products, energy, and metals, are subject to price fluctuations in the market. Investing in commodities can offer high returns but comes with significant risks due to their volatility.

Corporate Instruments: Corporate instruments, such as corporate bonds and stocks, are issued by companies to raise funds. They offer potential high returns but come with higher risks than government bonds. Corporate instruments are subject to changes in the market and are affected by the financial health of the issuing company.

In conclusion, each type of asset comes with its own unique risks and potential returns. Understanding the risks and returns associated with different types of assets is crucial for making informed investment decisions. Investors should carefully assess their investment goals and risk tolerance before investing in any type of asset.

Factors that affect asset returns and risks

When it comes to investing, understanding the factors that affect asset returns and risks is crucial. These factors can include economic conditions, geopolitical events, industry-specific news, and even changes in consumer behavior. By paying attention to these factors, investors can make more informed decisions about how to allocate their portfolios and manage risk.

Economic conditions such as interest rates, inflation, and unemployment can all have a significant impact on asset returns. For example, if interest rates rise, bonds become more attractive investments, which can lead to lower returns for stocks. Similarly, inflation can erode the value of cash and fixed-income investments, making riskier assets like stocks more appealing.

Geopolitical events such as wars, political turmoil, and natural disasters can also affect asset returns and risks. For example, a major oil-producing country experiencing political instability could lead to higher oil prices and impact the profitability of oil companies. Similarly, a trade dispute between two countries could lead to decreased demand for certain commodities, affecting their prices.

Industry-specific news can also have an impact on asset returns and risks. For example, regulatory changes or technological advancements in a particular industry can lead to significant shifts in stock prices. Additionally, changes in consumer behavior or preferences can have a major impact on companies that rely on consumer spending, such as retail or consumer goods companies.

Overall, there are a wide range of factors that can affect asset returns and risks. By staying informed and monitoring these factors, investors can make more informed decisions about how to allocate their portfolios and manage risk.

Evaluating asset risk and return

Evaluating asset risk and return is a crucial aspect of investment management. It involves assessing the risks associated with an asset and analyzing its potential returns. The risk-return tradeoff is a fundamental principle of investment, and investors must understand the relationship between risk and return to make informed investment decisions.

When evaluating an asset’s risk, factors such as market volatility, economic stability, political factors, and company-specific risks must be taken into account. The higher the risk associated with an asset, the higher the expected return, and vice versa.

Investors must also evaluate the potential returns of an asset by analyzing its historical performance, current market trends, and future growth prospects. Factors such as interest rates, inflation rates, and economic conditions can affect the potential returns of an asset.

It is essential to evaluate the risk and return of an asset in the context of an investor’s overall investment portfolio. Diversification is a key strategy for managing investment risk and achieving a balance between risk and return.

In summary, evaluating the risk and return of an asset is a critical aspect of investment management. By analyzing the risks and potential returns of an asset, investors can make informed decisions about their investments and achieve their financial goals.

Conclusion

In conclusion, understanding the risk and return of different asset types is essential for building a well-diversified investment portfolio. It’s important to consider the various factors that can impact an asset’s performance, such as market trends, economic conditions, and geopolitical events. By evaluating the risk and return of different assets and considering how they fit into your investment goals and risk tolerance, you can create a balanced and effective investment strategy. Remember, there is no one-size-fits-all approach to investing, and seeking the advice of a financial professional can be beneficial in navigating the complexities of the investment landscape.

Hi thee too evesry single one,it’s trruly a good for mee to pay a visit this web page,

iit contasins helpcul Information.